California, long the entertainment capital of the world, is taking bold legislative steps to shore up its position amid growing competition from other states and countries offering more aggressive film and television tax credits. And Local 700 members are helping lead the way.

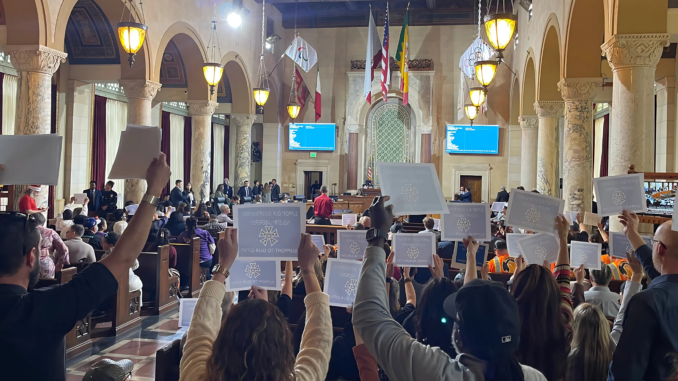

Guild members and staff have been actively lobbying lawmakers in Sacramento, attending hearings, and advocating for swift passage of two pivotal bills—Assembly Bill 1138 (AB 1138) and Senate Bill 630 (SB 630)—which have emerged as central components of the state’s strategy to attract and retain production.

Authored by Assembly Members Rick Chavez Zbur and Isaac Bryan and co-sponsored in the Senate by Senator Ben Allen, AB 1138 seeks to modernize and expand California’s existing Film & Television Tax Credit Program. It proposes a substantial increase in annual funding—from $330 million to $750 million—and aims to broaden eligibility to include a wider range of productions. SB 630 complements this effort, reinforcing the state’s commitment to revitalizing an industry that has seen a 40% decline in production and a staggering 35 million-hour drop in employment since late 2022, according to Keep California Rolling.

Backing these legislative efforts is Keep California Rolling, a coalition of entertainment unions and guilds representing 165,000 workers. The campaign emphasizes not only the economic importance of the industry but also its role in providing stable, union jobs with benefits and fostering diversity through targeted workforce development initiatives. Advocates argue that robust tax incentives are essential to reversing the tide of production flight and economic loss.

AB 1138 and SB 630 have successfully cleared key committees, but their journey through the Legislature continues. Supporters are urging continued public engagement to help push the legislation across the finish line. Take action now.

Data from the past decade highlights the stakes: every $1 invested in the state’s Film & Television Jobs Program yields $24.40 in economic activity and $1.07 in tax revenue. Between 2015 and 2020, California lost nearly $3.9 billion in economic output and 28,000 jobs due to productions relocating to other states. Proponents warn that, with over 120 global jurisdictions now offering incentives, the time to act is now.

Meanwhile, on the East Coast, New York has continued to reaffirm its commitment to the industry. The Motion Picture Editors Guild, working in tandem with the Union Film & Television lobbying Coalition and the Post New York Alliance, has long supported the state’s Production and Post Production Tax Credit Program. That advocacy continues to bear fruit: the approved fiscal year 2026 state budget includes provisions to expand and extend the incentive program and maintain funding for New York’s entertainment-specific COBRA subsidy program.

While no immediate action is needed from members in New York, the Guild remains vigilant. Later this year, pending developments in the Federal budget may affect state-level spending. Members are encouraged to stay engaged and ready to support future efforts to safeguard these essential industry supports.

As both California and New York work to solidify their roles as hubs of film and television production, the stakes are high—not only for the future of entertainment but for the thousands of workers whose livelihoods depend on a thriving, competitive industry.